Going through a merger or acquisition can be an exciting and emotional time. There are many questions surrounding new roles, business channels, production, compensation and sales territories. Think of it as driving a race car and changing the engine at the same time with the driver not knowing where the road ends.

Successful M&A planning requires swift execution within the first 100 days. During the M&A integration process, there is no magical one-size-fits-all approach. Instead, we recommend a tailored approach that focuses on the desired results based on the synergies of the group.

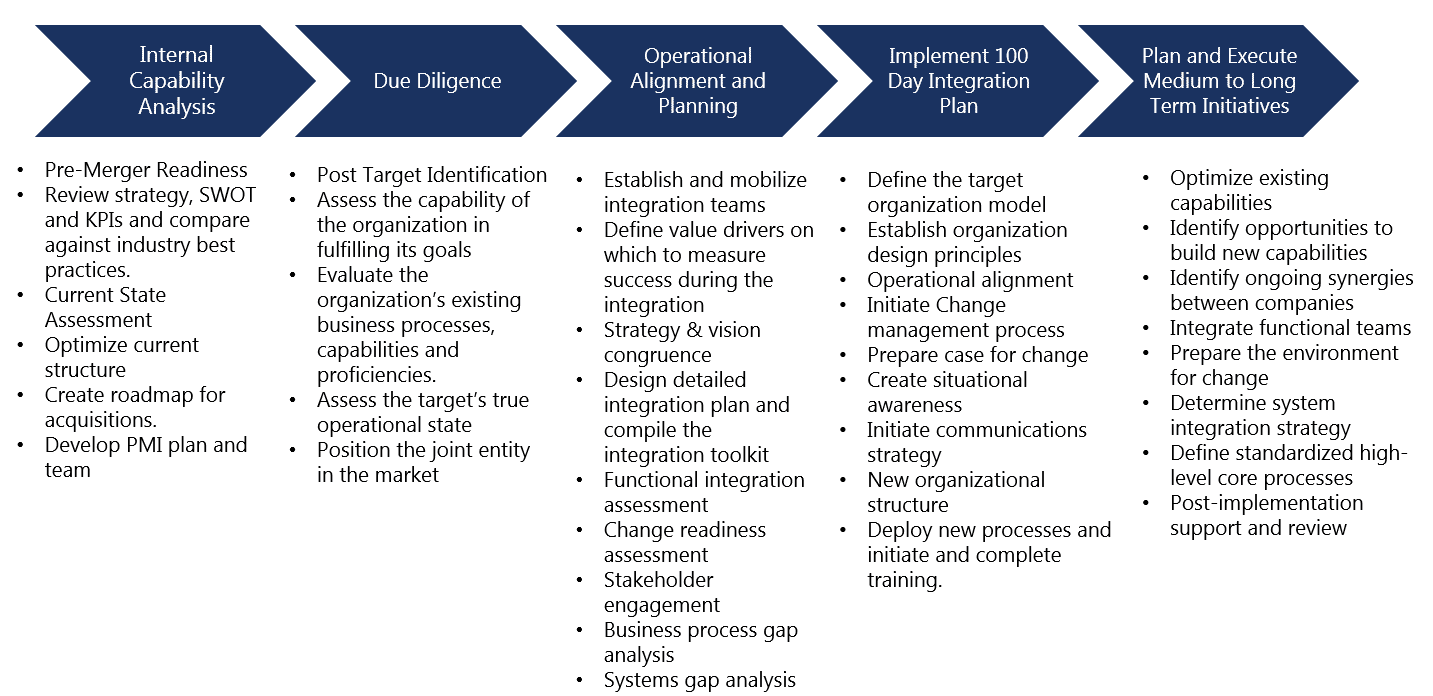

One Possible Pre-merger Readiness Approach

We often begin working with clients before the merger takes place. Typically, private equity (PE) firms or investment bankers work with us as we help clients determine their readiness to go through an M&A event.

1. Internal Capability Analysis & Pre-merger Readiness

When assessing readiness, we look at the reason the company wants to merge or acquire. For example, the organization may realize a smaller competitor has better agreements with vendors and therefore a pricing advantage.

While looking at reasons, we also determine key performance indicators and conduct a SWOT analysis (strengths, weaknesses, opportunities, threats).

Once we have a good understanding of where the organization is, we document the current state and conduct a gap analysis.

During the final steps of this phase, we create a roadmap and playbook with a clear path forward for internal cleanup. This roadmap sets up the post-merger integration framework.

2. Due Diligence Phase

Many times a merger or acquisition is opportunistic in the sense that two companies come together organically and decide they may want to merge. In other words, there is no formal search for an acquisition target.

Other times, a company will spend time searching for an acquisition target with the assistance of a PE firm. In cases like this, we have found that defining strategic objectives before looking at acquisition targets helps the organization effectively assess each potential acquisition.

While the organization is defining its strategic objectives, the PE firm typically performs financial, legal, compliance and valuation due diligence while we focus on evaluating the capabilities of the organization. We assess its ability to achieve its goals, the effectiveness of its current processes, its organizational structure and its technology.

We then compare the SWOT of the acquisition target to the SWOT of the acquirer, analyzing where there are synergies and how the two entities can grow and increase enterprise value.

3. Operational Alignment & Planning

During this time, a determination is made about the type of synergies to be achieved. We also determine the speed, extent and spirit of the integration, as well as the starting point of integration, the composition of the integration team and the decision-making approach.

We then determine the amount of change management necessary by conducting a change readiness assessment and considering the degree of change.

This phase allows us to seamlessly move from planning to operationalizing the plan to swift implementation.

4. 100 Day Integration Plan Execution

Following are seven tips for executing an integration plan:

- On Day 0, hit the ground running with extensive readiness checklists, and identify quick wins for the integration team to focus on.

- Chart a communication roadmap showing who will be informed at which times about which issues.

- Depending on the results of the change readiness assessment, determine the implementation approach in terms of phases of execution throughout the divisions of the company.

- While much information is lacking in this phase and an extensive amount of uncertainty exists, communication must be constant. Concerns among employees can be quickly dispelled through frequent and clear communication.

- Both companies must exchange all relevant information and quickly make individual integration concepts ready for implementation.

- Break down the expected synergies by region and department, and consolidate your business processes, personnel and systems by evaluating gaps, synergies and skillsets.

- Build a project management office to coordinate all activities and increasingly integrate the line organization.

Summary of an Effective Pre-merger Readiness Approach

Below is a general framework of the phases we have discussed and a sample of specific tasks during the lifecycle of a pre-merger and post-merger integration plan:

Do You Have a Post-merger Integration Team?

Many private equity firms do not have post-merger integration teams. If this describes your company, Panorama’s business transformation consultants can help you achieve a successful integration with our process integration work and our change management philosophy of looking at all areas of your business.