Panorama’s ERP Blog

Digital Transformation & ERP Best Practices

Need some quick tips for your digital transformation or ERP implementation? You’re in the right place.

The Hidden Costs of ERP Failure: Lessons from High-Profile Lawsuits

ERP failures often lead to hidden costs beyond budget overruns, including litigation, operational disruption, and reputational harm. High-profile lawsuits reveal common causes of ERP failure, such as misaligned expectations, vague contracts, and poor vendor oversight....

Enterprise Software vs. Business Strategy: Which Should Come First?

Business strategy should guide ERP selection to ensure technology aligns with long-term goals. ERP systems must support organizational processes and strategic direction. Aligning ERP strategy with business objectives improves efficiency, scalability, and user...

The Top 10 ERP Systems for the Food and Beverage Industry in 2025

While many ERP vendors claim “food and beverage industry capabilities,” only a few offer the nuanced features and AI-powered agility required in today’s environment. That’s why it’s important to understand which ERP platforms are purpose-built for your realities,...

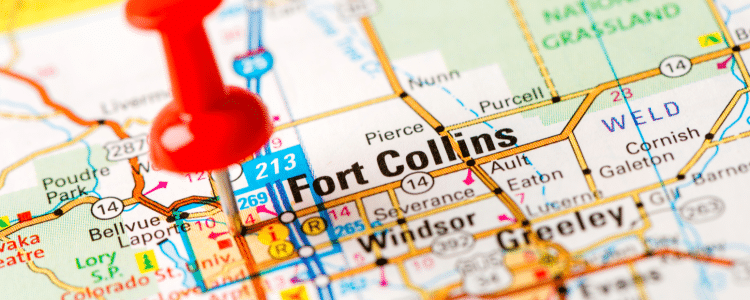

ERP Project Legal Risks – Open International vs. the City of Fort Collins

The Fort Collins vs. Open International lawsuit highlights how ERP failures often stem from flawed procurement, poor governance, and misaligned expectations. Key breakdowns included rushing vendor selection, unclear success metrics, and weak project oversight—all of...

Addressing Workflow Inconsistencies Within the Same Job Function

Inconsistent business processes often arise when individual employees change standard workflows to compensate for outdated tools or evolving business demands. Workflow inconsistencies within a job role can make it difficult to define requirements during ERP selection...

5 ERP Quick Wins That Sustain Momentum in Large-Scale Transformations

Common ERP quick win examples include early reporting pilots and simplified manual processes. Low-risk ERP improvements help teams show progress early without introducing rework or architectural debt later in the project. Knowing how to build momentum in digital...

Panorama’s ERP Blog

Welcome to the ERP Blog from Panorama Consulting, your central source for cutting-edge information and insight in the enterprise resource planning industry.

Digital Transformation and ERP Best Practices

Are you in the market for some quick tips to expedite your digital transformation or ERP implementation? Then you’ve come to the right place. As leaders in ERP consulting, Panorama is excited to provide valuable details about digital transformation and ERP best practices to those looking to expand their understanding of these vital practices and put them to use.

Enterprise resource planning (ERP) is a huge concept that essentially boils down to software that manages some of the most important day-to-day operations of businesses, such as accounting, project management, and procurement. What makes ERP so valuable is the fact that it facilitates a flow of information between these different processes and departments for a level of consistency that would not otherwise be possible. The result is an organization whose functions are more streamlined due to the use of a central database; employees from entirely different areas of a corporation can trust that they’re relying upon the same information and following the same practices when ERP is utilized.

There are many benefits for businesses that utilize ERP, including decreased costs of operation, boosted insights, greater efficiency, and an overarching sense of collaboration which serves to improve morale and company culture, so it’s no wonder that so many organizations invest time and resources into robust ERP efforts.

To stay up to date with current trends in ERP and to get more out of your current system, follow our blog.

If you aren’t currently investing in ERP for your organization, or if you feel that you aren’t properly leveraging this technology for your success, contact us to speak with one of our experts!